Where Now For Mortgage Rates?

By Dee Marie Fisher |

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief ...

Read More Where are Mortgage Rates Heading?

By Dee Marie Fisher |

The Top Indicator if You Want To Know Where Mortgage Rates Are Heading Mortgage rates have increased significantly since the ...

Read More Financial Benefits of Homeownership

By Dee Marie Fisher |

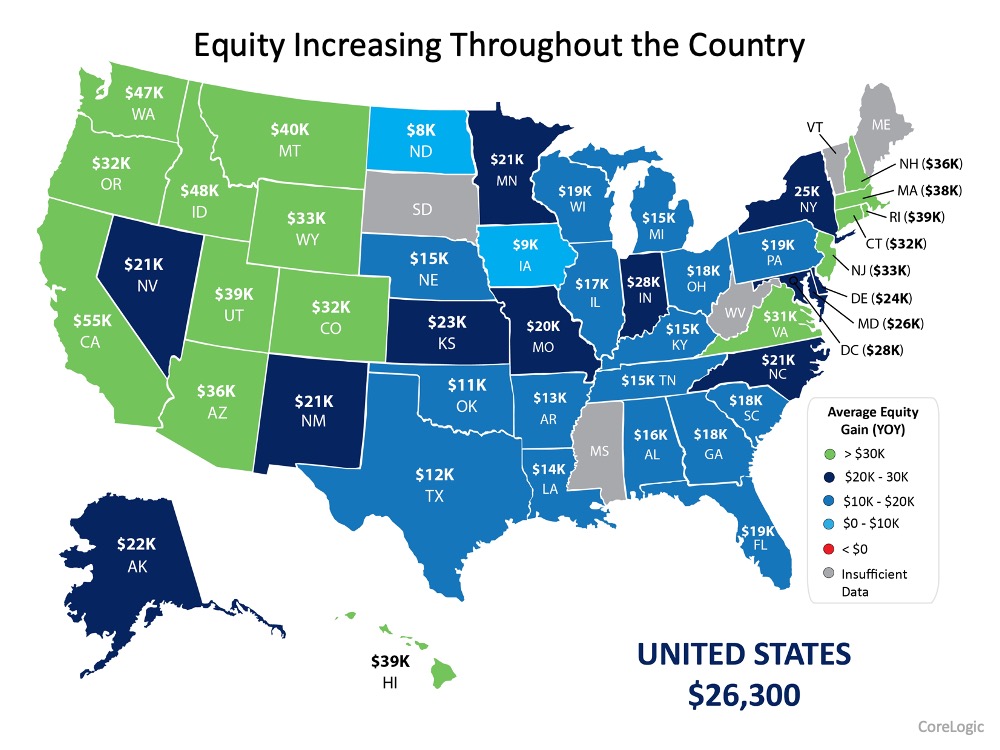

Wealth Building Through Real Estate Financial Benefits of Homeownership There are many financial and non-financial benefits of homeownership, and the ...

Read More Pensacola Rent Vs Buy Home

By Dee Marie Fisher |

The Cost of Renting Vs. Buying a Home [INFOGRAPHIC] Some Highlights The percentage of income needed to afford a median-priced home today ...

Read More Mortgage Rates by Decades

By Dee Marie Fisher |

Mortgage Rates & Payments by Decade [INFOGRAPHIC] Some Highlights Sometimes it helps to see the dollars and cents you’ll ...

Read More Mortgage Rates Hit Record Lows

By Dee Marie Fisher |

Mortgage Rates Hit Record Lows for Three Consecutive Weeks Over the past several weeks, Freddie Mac has reported the average 30-year fixed ...

Read More Appraisal Tips for Owners and Real Estate Agents

By Dee Marie Fisher |

How to Obtain a Good Appraisal…. The business of appraisals has changed since I started my real estate career many ...

Read More Can a 1% Hike in Mortgage Rates Really Stall Housing?

By Dee Marie Fisher |

Interest Rates and House Prices Last week's jump in mortage rates was the largest jump in 26 years from 3.98 ...

Read More Down Payments – Higher or Lower?

By Dee Marie Fisher |

Down Payment Options on Buying a Home Finding the right balance between a down payment and a loan amount may ...

Read More The 7 SIMPLE Steps of Escrow in California

By Dee Marie Fisher |

What is Escrow? In order to obtain home financing and have a home loan funded, a buyer must go through ...

Read More