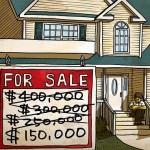

Home Buyers Happy and Home Sellers Sad….

This is a great time to buy a home in many parts of San Diego County because mortgage rates are at historic lows. The next few years could very well be remembered as the best opportunity for Americans to buy homes since the postwar baby boom.

But one group’s opportunity is another group’s problem. Tens of millions of baby boomers have seen their equity disappear completely when they were counting on their homes to help finance their retirement. After waiting for years for the market to to turn, now they are on the short end of the deal.

It’s really challenging to be a seller and if you are on the wrong side of the trade, here is a simple checklist to help you out…. the first 5 tips:

- Don’t hold your breath. The housing market isn’t like the stock market and bounce backs are typically slow. The last housing crash took more than a decade to work through and this market could take an especially long time. Unless you are willing to wait for a very long time, you may not want to get too hung up waiting for a big rebound.

- Look at your local market/neighborhood. As the housing market recovers, expect to welcome back the old Realtor’s adage: location, location, location. Where prices will go from here are determined on two factors: rents and valuations. If it’s cheaper to own than to rent, and rents in your neighborhood are rising, you can expect prices to rise in due course.

- Be realistic. The true value of your home isn’t what you paid or refinanced it for in 2006, but what it’s worth now. And the true value of your equity isn’t what you put into the home, it’s what you would get if you sold it.

- Know your “negative equity.” Estimates show that 11 million American homeowners are under water on their mortgages. If you’re in this position, you need to understand your legal status. Homeowners who are under water typically feel they can’t sell until they are level again, but that isn’t true. Your bank may be willing to accept a short sale. BUT remember the Mortgage Debt Relief Act ends December 31, 2012…. so now is the time to act!

- Look at your cash flow. Forget prices and the market, and look at your own cash flow. Ask yourself how much it’s costing you per month or year to stay in your own home, in terms of mortgage, property taxes, fees, maintenance and other expenses. On the other hand, how much would it cost to rent a home or buy a less expensive home instead?

- Put your own finances first. Smart financial management, like charity, begins at home. Many home owners have put their lives on hold – such as delaying a move or taking a job in another city – as they have waited for a rebound in home prices. This is time lost and it rarely makes sense. Economists would point out that these home owners are ignoring invisible “opportunity costs.” They are missing out on salaries, investments or life experiences that they otherwise would have enjoyed if they had sold earlier and moved.

- Sell today, buy tomorrow. Say you live in on the East Coast and you want to retire and move to Encinitas or Del Mar to be near your children, but you have been on hold…why wait? Yes, prices in Chicago are down 36% over the past six years, but San Diego area is down 39%. What you lose with one hand, you gain with another.

The bottom line? The national and San Diego housing market may take many years to recover. It’s a buyer’s market, but home owner’s hoping to sell need to do their math first and determine what is right for them. Call your real estate consultant for assistance.